Balanced approach = Steady returns?

- Thaddeus McCarthy

- May 17, 2024

- 3 min read

Updated: May 18, 2024

A balanced approach to investing could refer to a number of strategies. But what I am generally referring too by balance is to have a portfolio that isn't overly concentrated in any particular asset-type or sector. Two strategies I will look at in particular are the 60:40 portfolio and the Ray Dalio All-Weather. The other strategy that I will discuss is basically the no strategy strategy. This could range from being all in on one or two stocks or ETFs, right through to throwing darts at a board.

The 60:40 portfolio is comprised of 60% stocks and 40% bonds. The general idea behind it is that your portfolio will do good in bull markets with stocks, and hold up in bear markets with the 40% bond holdings. If you are a DIY investor using Hatch or Sharesies, it would be pretty easy to construct a 60:40 portfolio by buying a Total World Stock ETF and an assortment of Government Bond ETFs. Over the last few years the 60:40 portfolio has way underperformed an all-equity portfolio. This is because while bond yields are high at around 5%, the coupon value of the bonds has been moving inverse to the yields. Meanwhile, the market isn't dominated anymore by high-yielding stocks that often compete with bonds; it is dominated by the likes of Nvidia and Microsoft, that have little or no yield. Even prior to the last few years, between 1926 and 2017, large-cap stocks returned 10.2%, while long-term government bonds only returned 6.1%. So over time, your bond holdings would hinder your compounded returns.

How about Ray Dalios All Weather Portfolio, as described in the Tony Robbins book, 'Money: Master the Game'. It is comprised of 55% bonds, 30% US Stocks and 15% hard assets and commodities. The aim of the strategy is to use diversification as a way to smooth returns and limit drawdowns. The limited exposure to stocks is meant as a way to protect the portfolio across a range of markets, including in flat and bear markets. It accounts for different environmental sensitivities in the pricing structure of assets classes. Gold has returned 521% over the last 30 years, 80% over the last 10, and 17% over the past year. The S and P 500 has returned around 1000% over the last 30 years, 180% over the last 10, and 21% over the last year. So if you are holding over the long term your commodity holdings and basically static bond holdings would hinder your stock returns. Interestingly, in 2008/2009 gold would not have protected you from the great recession.

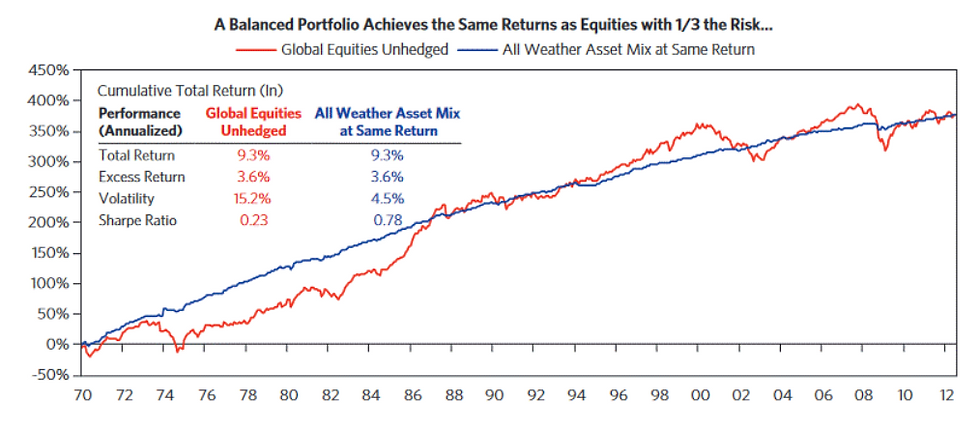

As seen in the graph below, what the All Weather does is smooth out your returns, which means that timing the markets isn't much of an issue.

So what about if you just throw all of your money into one or two stocks? After all, when you think of the wealthiest people in the world; Bill Gates with Microsoft, Larry Ellison with Oracle, Andrew Forrest with Fortescue, these people got wealthy from their ownership in one company. So why not try the same tact when it comes to your own investing? Simple really, in the examples I gave these billionaires started the companies, and were intimately involved in the day-to-day. Investing in the stock market, you will probably not be involved in a companies day-to-day operations. You never know for certain what is around the corner, and it is for this reason that you should be diversified. But how diversified should you be? Warren Buffett says that over-diversification is just a protection against ignorance. Jim Cramer says that an individual investor doesn't need more than 5-10 stocks in their portfolio.

Its hard to know what to do when investing your hard earned money. But I think what Buffett and Cramer say about not being overly diversified is wise. The Ray Dalio approach about being invested across different asset classes also has merit. There are bits and pieces you can take from many different strategies to find the one that best suits you and for your portfolio.

Comments